osceola county property tax estimator

If the estimated tax is greater than 10000 tangible personal property taxes may be paid quarterly. You can now access estimates on property taxes by local unit and school district using 2020 millage rates.

2505 E Irlo Bronson Memorial Highway.

. Therefore the countys average effective property tax rate is 086. Taxes become delinquent April 1st each year at which time a 15 percent fee per month is added to the bill. The median property tax also known as real estate tax in Osceola County is 114800 per year based on a median home value of 10110000 and a median effective property tax rate of 114 of property value.

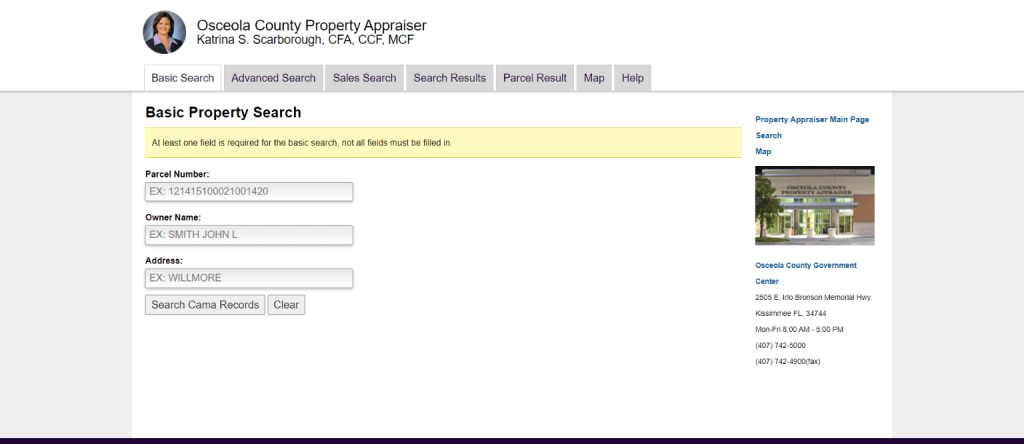

Osceola County Florida Property Search. The Property Appraisers Office establishes the assessed value of a property and The Board of County Commissioners and other levying bodies set the millage rates. The median property tax also known as real estate tax in Osceola County is 73400 per year based on a median home value of 7020000 and a median effective property tax rate of 105 of property value.

JANUARY 15 2015 - PHISHING. Find Mississippi County Property Tax Collections Total and Property Tax Payments Annual. If purchasing new property within Florida taxes are estimated using a 20 mill tax rate.

Simply enter the SEV for future owners or the Taxable Value for current owners and select your county from the drop down list provided. Under Florida law e-mail addresses are public records. Effective March 30 2015 Class E Driving Skills Test offered at the Main Office of the Osceola County Tax Collector by appointment only.

The countys average effective property tax rate comes in at 086 with a. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email.

Within 45 days after the property becomes delinquent the Tax Collector is required by. If you do not want your e-mail address released in response to a public records request do not send electronic mail to this entity. Actual property tax assessments depend on a number of variables.

You will then be prompted to select your city village or township along. Mississippi County Property Tax Collection Statistics. Using these figures the Property Appraiser prepares the tax roll.

We enjoyed seeing everyone at the Silver Spurs Rodeo Parade in downtown City of St. Visit their website for more information. Weve made some changes to saved payment functionality in TouristExpress.

The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. Scarborough CFA CCF MCF March 8 2022 507 pm. My team and I love connecting with the community and look forward to future parades.

The median property tax on a 19920000 house is 209160 in the United States. Parcel Number Owner Name Address. The estimated tax range reflects the lowest to highest total millages for the taxing authority selected.

These can be deleted by clicking the remove button in the bottom right corner of the payment information box. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart. You may see duplicate saved payment methods on your profile page.

Search all services we offer. Osceola County collects on average 095 of a propertys assessed fair market value as property tax. Property Appraisers Office 2505 E Irlo Bronson Memorial Hwy Kissimmee FL 34744.

Parcel Number Owner Name Address. We use a Market Value range of 875 to 1125 of the purchase price you enter. Cloud Florida a couple of weeks ago.

The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of 095 of property value. American Community Survey 2018 ACS 5-Year Estimates. Osceola County has one of the highest median property taxes in the United States and is ranked 516th of the 3143 counties in order of median property taxes.

Property taxes in Brevard County are somewhat lower than state and national averages. Osceola County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Osceola County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections.

Osceola County Property Appraiser Katrina S. The following services are offered by the Property Appraisers Office. It is the responsibility of each taxpayer to ensure that hisher taxes are paid and that a tax bill is received.

Osceola County collects relatively low property taxes and is ranked in the bottom half of all counties in the United States by property tax collections. For the 4th year in a row the taxable value is at an increase for. Osceola County Property Appraiser.

Irlo Bronson Memorial Highway. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Osceola County. Osceola County Property Appraiser Releases 2016 Tax Estimates.

No walk-ins will be accepted for driving skills test. On Wednesday June 1st the Osceola County Property Appraiser Katrina Scarborough submitted the taxable value estimates to the Osceola County taxing authorities. Osceola County Florida Property Search.

For more information go to the Tax RollMillages link on the homepage. 06-10-2016 June 3 2016 Kissimmee FL. Gross amount paid in March no discount applied.

Our Osceola County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Michigan and across the entire United States.

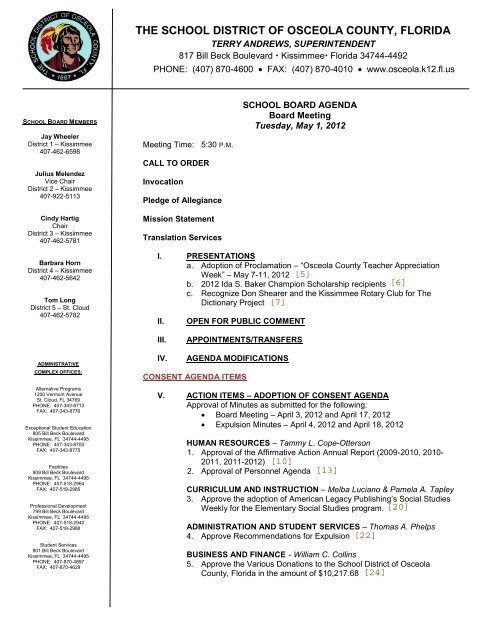

The School District Of Osceola County Florida

Property Search Osceola County Property Appraiser

Free Credit Report Offers Extended Complaints Have Increased Florida Realtors In 2021 Credit Score Check Credit Score Better Credit Score

Osceola County Property Appraiser How To Check Your Property S Value

School Board Meeting Agenda Packet Osceola County

Osceola County Property Appraiser How To Check Your Property S Value

Property Search Osceola County Property Appraiser

Property Search Osceola County Property Appraiser

Property Search Osceola County Property Appraiser

Osceola County Property Appraiser How To Check Your Property S Value