nassau county property tax rate

Census does not provide data to calculate. While its far too early to tell exactly what kind of year 2022 will be from a Nassau County property tax perspective its clear there are certain things that taxpayers can rely upon.

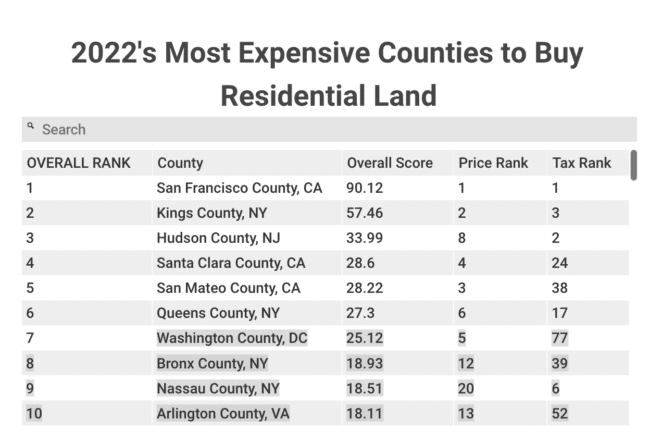

Hudson County Ranks 3rd Most Expensive County To Buy Residential Land In Usa Hoboken Girl

What Is the Nassau County Property Tax Rate.

. You can pay in person at any of our locations. The tax rates for all the other taxing jurisdictions in which your property is located are added together and that. Where possible it is recommended that.

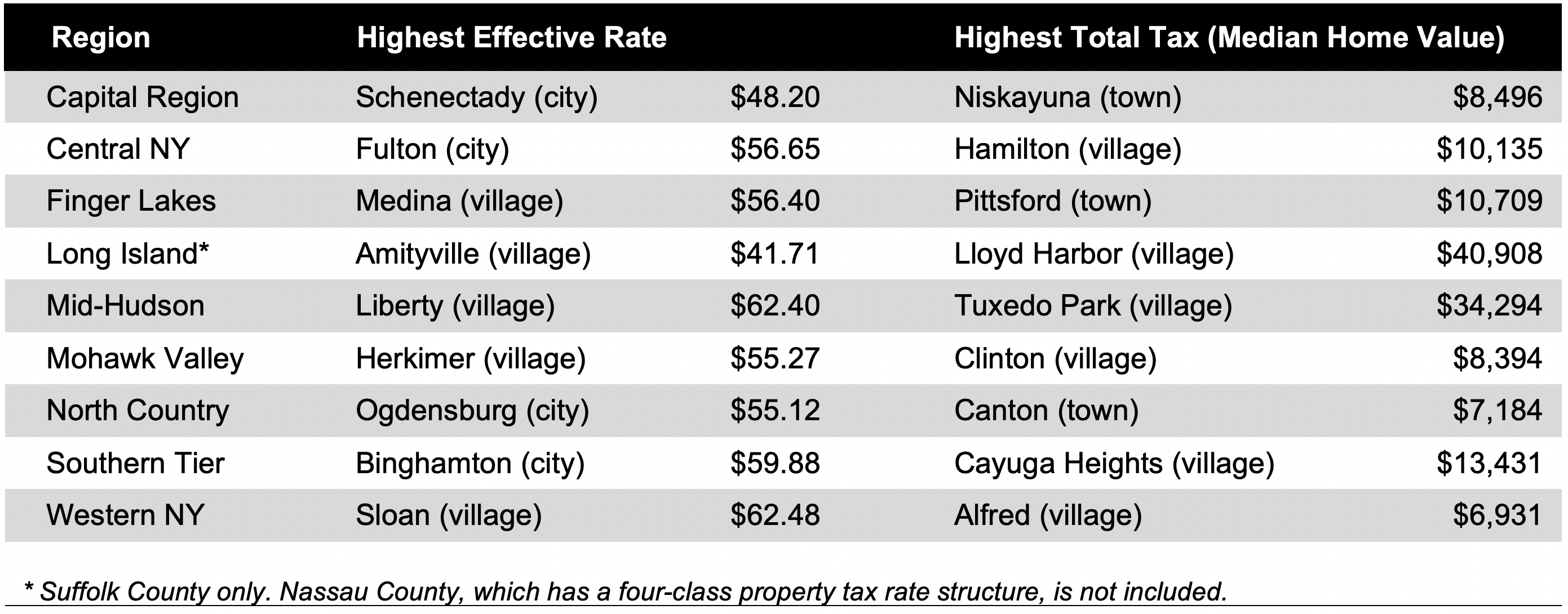

Nassau County New York. Long Island property tax is among the countrys highest due to high home prices and high tax rates. This is the total of state and county sales tax rates.

Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. Hours of operation are 900am to 430pm Monday through Friday. Ad Get Record Information From 2021 About Any County Property.

In November of 2019 the median pending sale price for a residential condominium or co-op property was 525000. Find All The Record Information You Need Here. Unsure Of The Value Of Your Property.

240 Old Country Road 4 th Floor. If you would like. Nassau County Department of Assessment 516 571.

Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. The New York Comptrollers.

Taxes for village or city purposes and for school purposes are billed separately. Read on to learn more about the property tax rates in. The median property tax also known as real estate tax in Nassau County is 157200 per year based on a median home value of 21360000 and a median effective property tax rate of.

2022 Homeowner Tax Rebate Credit Amounts. Nassau County Tax Collector. Nassau County collects on average 179 of a propertys assessed.

When they moved into a new Plainview development last year residents like the Blattbergs thought property taxes on their two-bedroom apartment would be around 20000. Local Property Tax Levy Rise to Be Capped at 2 Next Year While the 2 percent figure is well above the 156 percent increase provided for in 2021 its good news for Nassau County. So if your tax jurisdiction determines that the value of your property is 200000 and the tax rate is 2 your tax bill comes out to 4000.

This is the total of state and county sales tax rates. Learn all about Nassau County real estate tax. Whether you are already a resident or just considering moving to Nassau County to live or invest in real estate estimate local property.

A year later it was 600000 a 143 percent increase. What is the property tax rate in Nassau County. Whether you are presently living here just considering moving to Nassau County or planning on investing in.

Explore how Nassau County applies its real estate taxes with this thorough review. Nassau County collects on average 179 of a propertys assessed fair market value as property tax. 86130 License Road Suite 3.

My Nassau Information Lookup. Fernandina Beach FL 32034. The median property tax also known as real estate tax in Nassau County is 871100 per year based on a median home value of 48790000 and a median.

Nassau County property taxes are assessed based upon location within the county. Below are the homeowner tax rebate credit HTRC amounts for the school districts in your municipality. The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes.

Is my property assessment a tax. The Nassau County Treasurers Office has resumed limited in person access. If the check amount.

Visit Nassau County Property Appraisers or Nassau County Taxes for more information. Nassau County has one of the highest. For counties where median real estate taxes surpass 10000 the US.

Enter your Address or SBL to get information on your.

2022 Best Places To Retire In Nassau County Ny Niche

Why Are Property Taxes So High In Long Island New York

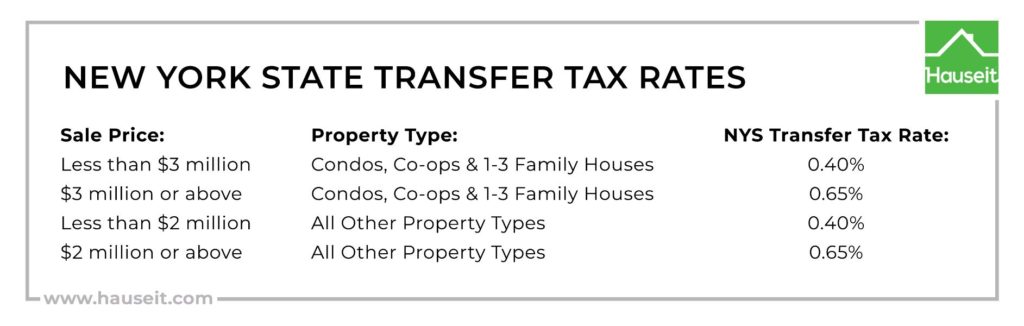

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Nyc Property Tax Bill Online Discount Shop For Electronics Apparel Toys Books Games Computers Shoes Jewelry Watches Baby Products Sports Outdoors Office Products Bed Bath Furniture Tools Hardware Automotive

Wichita Falls Isd Approves 2021 2022 Tax Rate

Don T Forget About Property Taxes When You Are Looking To Purchase A New Home Property Tax Grievance Heller Consultants Tax Grievance

Property Taxes Polk County Tax Collector

Why Are Property Taxes So High In Long Island New York

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Otsego County Ny Property Tax Search And Records Propertyshark

Homeowners Saw Their Property Taxes Take A Big Leap Last Year Cnn Business

Faqs On Lipa Court Judgment Vs Accepting Lipa S Proposal Town Of Huntington Long Island New York

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Suffolk County Ny Property Tax Search And Records Propertyshark

Fulton County Residents Who Live In A Home They Own May Be Able To Reduce Property Taxes By Making Sure They Are Ta Property Tax Mortgage Rates Property Values