unemployment tax credit check

Please note that the unemployment provision of the American Rescue Plan Act is an exclusion from income not a tax credit. Get in Touch.

Why You May Have To Wait Until Next Year S Tax Season To Claim All Your Stimulus Benefits

Heres how to claim it even if youve already filed.

. This means up to 10200 of unemployment compensation is not taxable on your 2020 tax return. ANCHOR payments will be. Efile your tax return directly to the IRS.

Also note that Form 1099-G does not show the amount that you. Your customizable and curated. June 1 2021 435 AM.

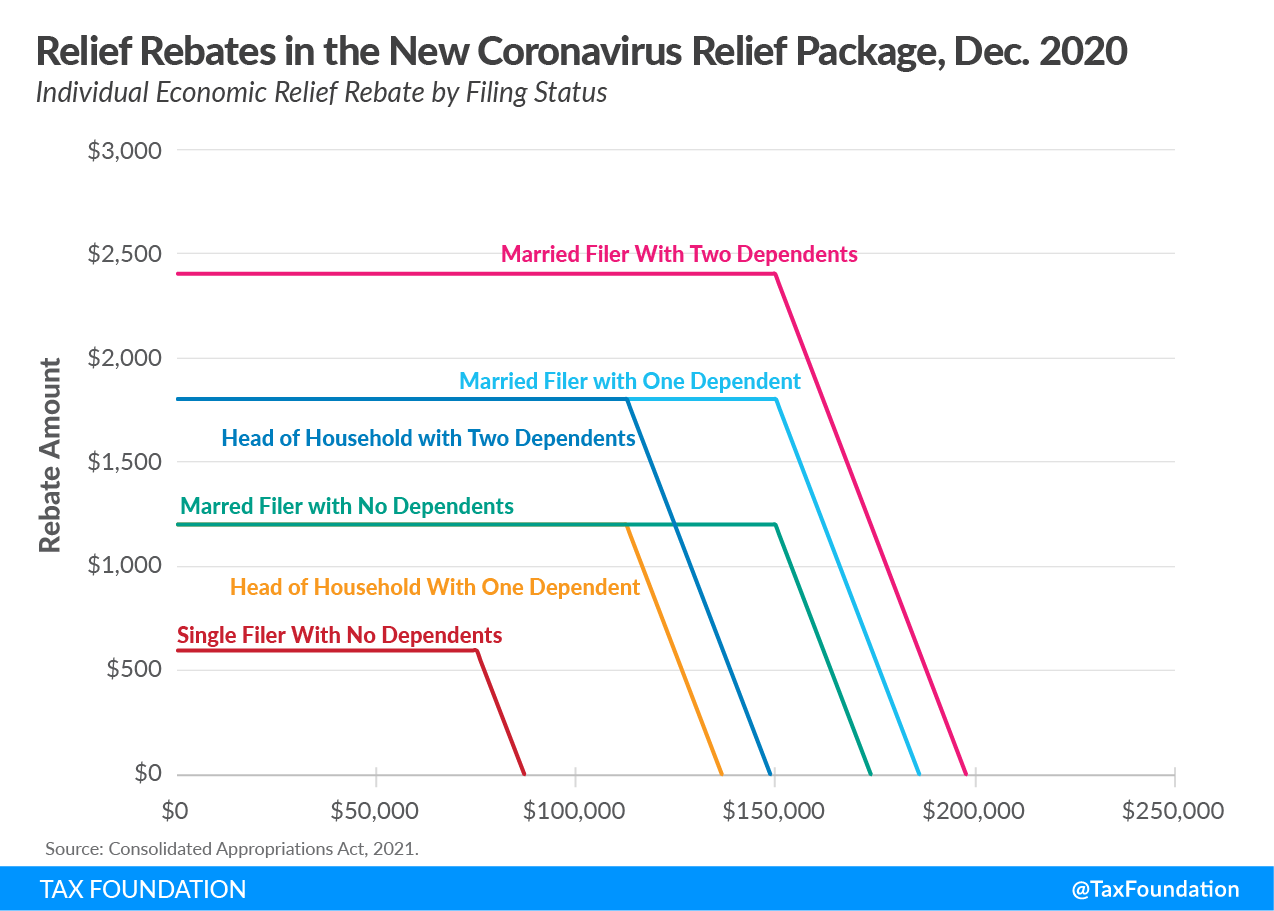

The Advanced Premium Tax Credit is based on the amount of income on your 2021 Get Covered New Jersey application. Meanwhile the IRS will start sending monthly payments of the child. 1200 in April 2020.

The IRS has just started to send out those extra refunds and will continue to send them during the next several months. At least 23 states are withdrawing from federal unemployment programs between mid-June and mid-July. More money is arriving for unemployment-related tax refunds via direct deposit and paper checks.

The Child Tax Credit is expected to roll out July 15. If your tax liability what you owe in taxes for this year is below 2000 then you will. If you havent received your child tax credit payment the first thing you should do is check the IRSs child tax credit update.

To report unemployment compensation on your 2021 tax return. 2021 tax preparation software. Form 8962 will look at your final 2021 income as reported on your.

COVID-19 Stimulus Checks for Individuals. Check the child tax credit update portal. 100 Free Tax Filing.

The latest stimulus includes a federal tax exemption for up to 10200 in unemployment benefits received in 2020. More money is arriving for unemployment-related tax refunds via direct deposit and paper checks. The deadline for filing your ANCHOR benefit application is December 30 2022.

The Child Tax Credit is expected to roll out July 15. Fort Lee NJ 07024 201 308-9520. On Form 1099-G.

We will begin paying ANCHOR benefits in the late Spring of 2023. The IRS is sending tax refunds to Americans who filed for unemployment but submitted tax returns before Biden introduced the American Rescue Plan Credit. The Child Tax Credit is worth up to 2000 per qualifying child with a refundable portion of up to 1400.

The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form. In Box 1 you will see the total amount of unemployment benefits you received.

In Box 4 you will see the amount of federal income tax that was. You cannot check it. Unemployment tax credit check Sunday March 27 2022 Edit.

Prepare federal and state income taxes online.

Brproud Still Waiting On Your Unemployment Refund Irs To Send More Checks In July

Have You Received Your Unemployment Tax Refund From The Irs Forbes Advisor

Coronavirus Relief Package 600 Stimulus Check 300 Unemployment

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

2020 Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

Unemployment Update How To Get 10 200 Unemployment Tax Free Step By Step Youtube

Nc Issuing Unemployment Tax Credit For 1st Quarter 2020

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Is Unemployment Taxed H R Block

Unemployment Benefits Are Taxable Income That May Reduce Eitc Refunds Next Spring Tax Policy Center

What Happens If I Forgot To File Unemployment Benefits In 2021 As Usa

Ct Dept Of Labor Recent Irs Guidance On The 1099g Tax Form

H R Block Turbotax Help Filers Claim 10 200 Unemployment Tax Break

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Unemployment Benefits And Child Tax Credit H R Block

Fourth Stimulus Check Update 1400 Stimulus Check Unemployment 300 Child Tax Credit 1k Grants Youtube

Tax Refunds On Unemployment Benefits Still Delayed For Thousands